2016年12月7日 星期一

随着儿童税收抵免过期 数百万美国家庭再度贫困

As US families stare down the twin barrels of the lingering Covid-19 pandemic and rising inflation, Congress has let expire the Child Tax Credit, a critical source of income which lifted 61 million children out of poverty since its implementation last July.

The Child Tax Credit, which expired Dec. 31, 2020, gave direct payments of $300 per month to children below the age of 6 and $250 per month for children above the age of 6. The monthly payments meant families could immediately access the benefits without waiting a year to receive the credit.

At an Ethnic Media Services briefing Jan. 7, advocates discussed the importance of the benefit and the need for Congress to continue the lifeline.

【美新社讯】众多美国家庭面临新冠肺炎(COVID-19)疫情大流行持续肆虐和不断增加的通货膨胀的双重影响,特别是来自新的奥密克戎(Omicron)变种病毒的威胁,可能会造成新的一轮失业潮。而儿童税收抵免(Child Tax Credit)已经过期,这是自去年 7月实施以来,使 6100万 儿童摆脱贫困的重要收入来源。但美国国会没有对其进行延长。

儿童税收抵免(Child Tax Credit)在2021年12月31日过期,它为美国家庭中 6岁以下 的儿童提供每月 300 美元的直接付款,为 6岁以上 的儿童提供每月 250 美元的直接付款。每月付款意味着家庭可以立即获得福利,而无需等待一年才能收到信用。

1月7日,由少数族裔媒体服务(Ethnic Media Services,简称EMS)召集的近百位来自华裔、韩裔、印度裔等亚太裔,以及拉丁裔、非洲裔等少数族裔的媒体代表参加网络研讨会。倡导者讨论了儿童税收抵免(Child Tax Credit)、这一福利的重要性,以及国会继续维持该生命线的必要性。

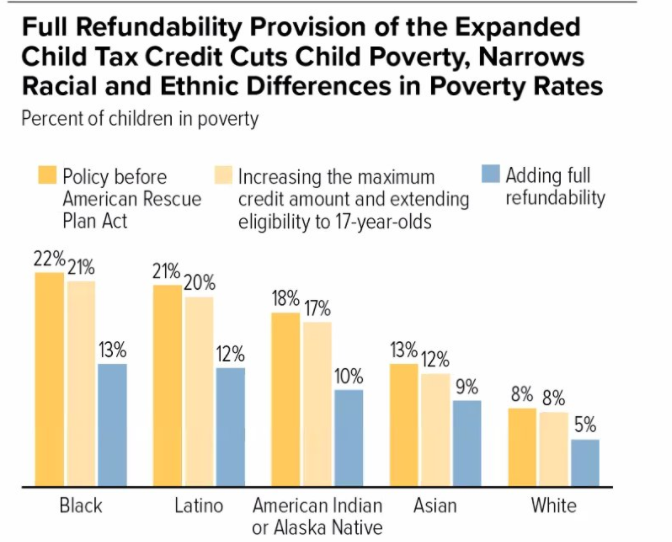

The credit has been projected to reduce annual child poverty by more than 40 percent, said Claire Zippel, Senior Research Analyst in the Income and Poverty Trends team at the Center for Budget and Policy Priorities. “We know that reducing child poverty helps children healthier and do better in school and really sets them up for success as adults,” she said.

Previously, 27 million children didn't receive the full credit amount because their families earned too little. But under the rescue plan, children and families with low or no income in a year, got the same amount of the credit as children and families with higher incomes, said Zippel.

预算和政策重点中心(cbpp.org)的收入和贫困趋势团队的高级研究分析师 克莱尔·齐佩尔(Claire Zippel)指出,儿童税收抵免(Child Tax Credit)预计将每年减少 40% 以上的儿童贫困。她强调,“我们知道,减少儿童贫困,有助于让儿童更健康,在学校表现更好,并真正为成年后的成功做好准备。”

分析师 克莱尔·齐佩尔也指出,此前,有 2700万 儿童因家庭收入太少,而未能获得全额信贷。但根据《美国救助计划法案》(American Rescue Plan Act 2021),一年内低收入或无收入的儿童和家庭获得的信贷额度,与收入较高的儿童和家庭相同。

The expansion is projected to cut the percent of black children in poverty from 22 percent to 13 percent and the percent of Latino children in poverty from 21 percent to 12 percent.

91 percent of the credit was used by families for basic necessities, such as food, housing, clothing, utility, bills and education, said Zippel.

《美国救助计划法案》(American Rescue Plan Act 2021)下,这一信贷的扩张,可以把贫困黑人儿童的百分比从 22% 减少到 13%,可以把贫困拉丁裔儿童的百分比从 21% 减少到 12%,可以把贫困美国印第安和阿拉斯土著儿童的百分比从 18% 减少到 10%,可以把贫困亚裔儿童的百分比从 13% 减少到 9%,也可以把贫困白人族裔儿童的百分比从 8%减少到5%。

另一方面,分析师 克莱尔·齐佩尔也指出,统计显示儿童税收抵免(Child Tax Credit)信贷的 91% ,被家庭们用于基本必需品开销,例如食物、住房、衣服、公用事业、账单和教育。其重要性和必要性可见一斑。

“Hunger rose from 10 million in 2019 to 12 million in 2020. Black and Latino children are twice as likely to face hunger because of systemic racism," said Loree D. Jones, CEO of Philabundance, a hunger relief project in Philadelphia, one of the poorest large cities in the US.

"We know a safety net is not a sustainable solution. Systematic change like the child tax credit are a more sustainable winning strategy,” said Jones. "I remain optimistic because for the first time in a long time, because things are so hard, we do have the will to get this done for our kids."

Philabundance has provided 70 thousand culturally responsive meals to Afghan refugees, and provided food during Ramadan so Muslim families had food to break their fasts.

在美国最贫穷的大城市之一费城运作的“费城饥饿救济项目”(Philabundance.org)的首席执行官洛丽·D·琼斯(Loree D. Jones)指出,“疫情之下,饥饿儿童人口从 2019年 的 1000万,增加到 2020 年的 1200万。同时,由于系统性种族主义,黑人和拉丁裔儿童面临饥饿的可能性是其他族裔的两倍。”

琼斯强调,“我们知道安全网不是一个可持续的解决方案。像儿童税收抵免这样的系统性变革是一个更可持续的成功策略。对此,我保持乐观,因为这是很长一段时间以来第一次针对性的改革。目前,(疫情造成的)损害太严重了,我们有意愿为我们的孩子完成改革立法。”

费城运作的费城饥饿救济项目(Philabundance.org)已为阿富汗难民提供了 7万份 文化响应餐,并在斋月期间提供食物,以便穆斯林家庭有食物开斋。

Expansion of the credit is tied to the $1.7 trillion Build Back Better bill currently being debated by Congress: the child tax credit would add an estimated $105 billion per year to the budget, said Michelle Dallafior, Senior Vice President of Budget and Tax at First Focus on Children.

“We are at an incredibly pivotal moment for our nation’s children,”she said. “We urgently need to pass the Build Back Better Act.”

“最先关注儿童 ”组织(firstfocus.org)的预算和税收高级副总裁 米歇尔·达拉菲奥 (Michelle Dallafior) 指出,儿童税收抵免信贷的扩张,与价值1.7万亿美元《更好重建法案》(Build Back Better Act)新提案有关,目前正在国会参议院研讨。儿童税收抵免信贷的扩张,预计每年将增加预算1050亿美元。

她强调说“对于我们国家的孩子来说,我们正处于一个令人难以置信的关键时刻,我们迫切需要通过《更好重建法案》。”

“Support for children is too often viewed as something that can be cut when negotiations are under way,” said Dallafior. She noted that there is standalone legislation for the child tax credit that exists in both the House and Senate, which would separate it from the Build Back Better bill, but the probability of getting a standalone bill passed was not high.

“The moment is now, and our Congressional Champions feel the same way: we just can't leave kids behind,” said Dallafior.

米歇尔·达拉菲奥也指出:“在谈判进行时,对儿童的支持,往往被视为可以削减的东西。国会众议院和参议院,都有关于儿童税收抵免的独立立法,这将使其与《更好重建法案》分离,但单独法案获得通过的可能性并不高。

“现在是时候了,我们的国会立法者们也有同样的感受:我们不能让孩子落后。” 米歇尔·达拉菲奥强调说。